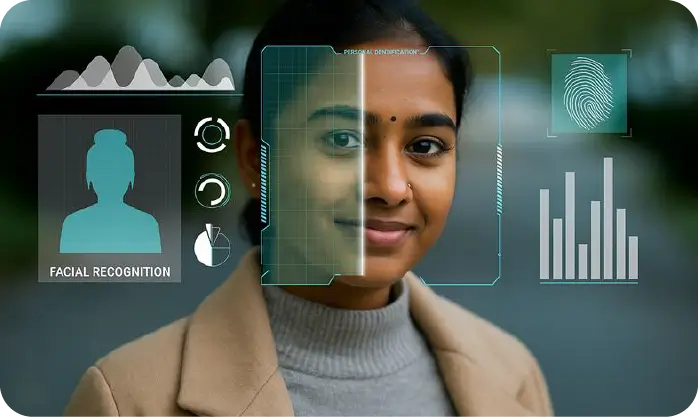

IT Solutions for Banking & Finance

In a sector where trust is currency, your bank’s technology must be secure, efficient, and customer-centric. With the right tech stack, Rapidsoft delivers a suite of powerful IT solutions that make banking ready for the four main pillars of doing business: fast, scalable, secure and transparent. Automate 90% of repetitive back-office tasks, offer personalised services to HNIs, and let AI communicate on your behalf. Let's make banking faster and safer together. Call now!